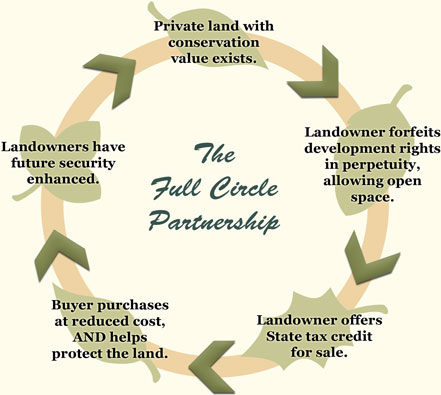

Become Part of this Full Circle Partnership

Conservation easements are critical to the preservation of Virginia’s scenic vistas, agriculture, forests, and watersheds.

Comprehensive and Individualized Assistance for Taxpayers and Landowners

For over 55 years, the State of Virginia has provided a private-public partnership approach to preservation of land with public value. Owners of large properties who have chosen to forfeit development rights forever are allowed some State income tax credit as partial compensation.

Beginning in 2002, Virginia allows this donor-landowner to sell and transfer credit to other Virginia income taxpayers when he cannot use all the credit for himself in the allotted years.

Being the first in the State to sell and transfer Virginia land preservation tax credit, having donated three conservation easements ourselves and re-invested in land conservation, and continuing to purchase tax credit ourselves, we have a thorough understanding of the perspective of a donor-landowner and of a buyer.

Agriculture

Scenic Viewshed

Forestry and Wildlife

Our Guidelines ~

To treat everyone right and protect the Virginia land preservation program, we:

1 Assist landowners with conservation easement donations and streamline sales of their tax credit.

2 Do what we can to maintain a fair market rate for landowners and individual buyers and one which supports the overall program.

3 Offer inclusiveness to any State taxpayer regardless of tax liability.

4 Make purchasing of tax credit nearly effortless for our buyers.

5 Protect value received by all parties through high conservation standards, careful documentation, and win-win-win ethics.